oklahoma auto sales tax and fees

The state also has some special taxes and levies discretionary taxes local sales and. Oklahoma charges 45 percent state sales tax on sales of tangible personal property and certain services.

A Complete Guide On Car Sales Tax By State Shift

What is the auto tax in Oklahoma.

. 125 sales tax and 325. The county the vehicle is registered in. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Multiply the vehicle price after trade-ins and incentives by the sales.

5 rows Oklahoma charges two taxes for the purchase of new motor vehicles. Average Local State Sales Tax. Multiply the vehicle price after trade-ins and incentives.

Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. We would like to show you a description here but the site wont allow us. To calculate the sales tax on your vehicle find the.

The cost for the first 1500 dollars is a flat 20 dollar fee. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. Auto Sales Tax information registration support.

Ad Get Oklahoma Tax Rate By Zip. Oklahoma also has a vehicle excise tax as follows. Counties and cities can charge an.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state. How do you calculate sales tax on a car. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45. How to Calculate Oklahoma Sales Tax on a New Car. 325 of the purchase price or taxable value if different Used Vehicle.

2000 on the 1st 325 of the remainder New BoatMotor. Free Unlimited Searches Try Now. Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Bad Credit Loans.

Tax and Tags Calculator. Motor Vehicle Excise Tax Purchase Types New Vehicle. Ad New State Sales Tax Registration.

Typically the tax is determined by. Exact tax amount may vary for different items. An example of an item that exempt from Oklahoma is.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. In Oklahoma this will always be 325.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

There is also an annual registration. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Oklahoma Who Pays 6th Edition Itep

What S The Car Sales Tax In Each State Find The Best Car Price

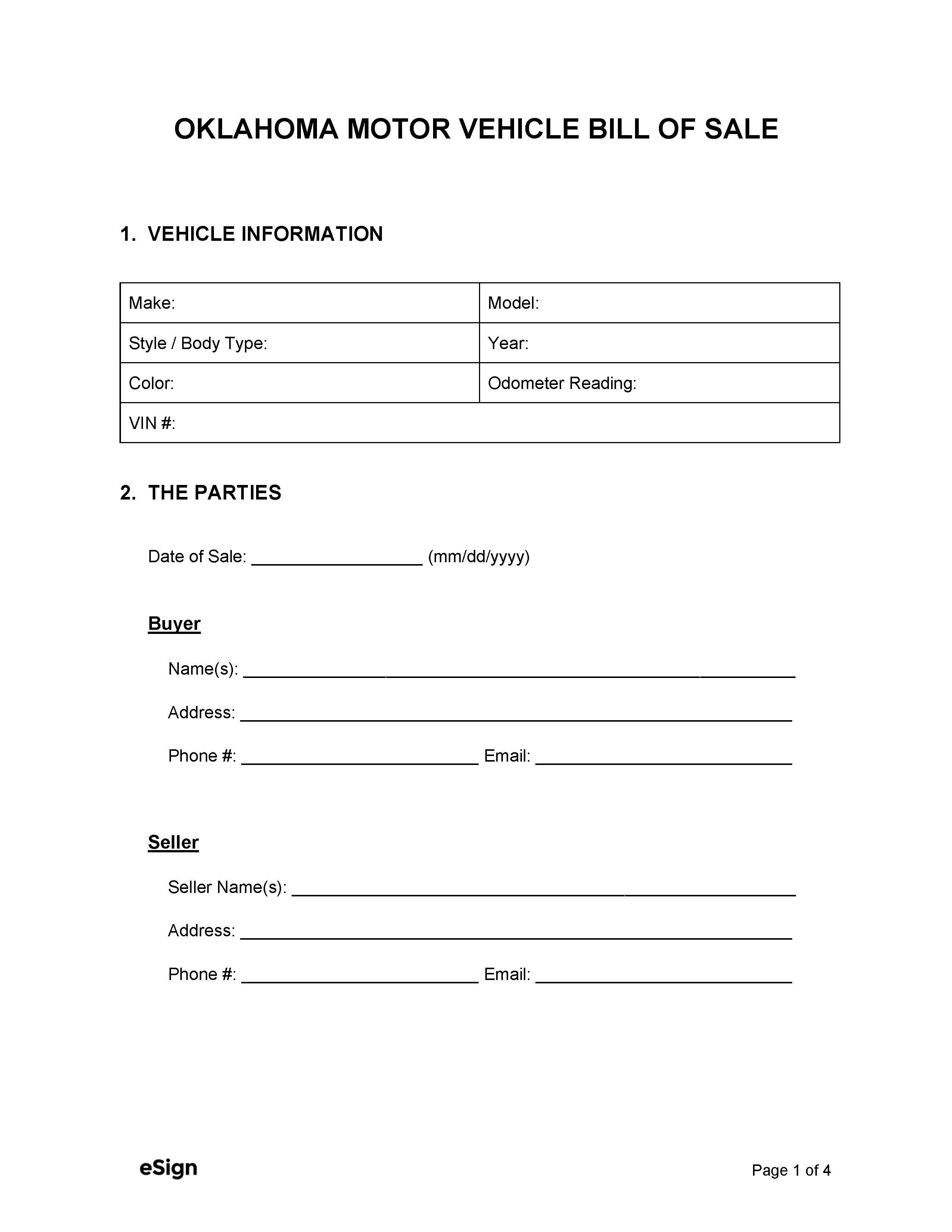

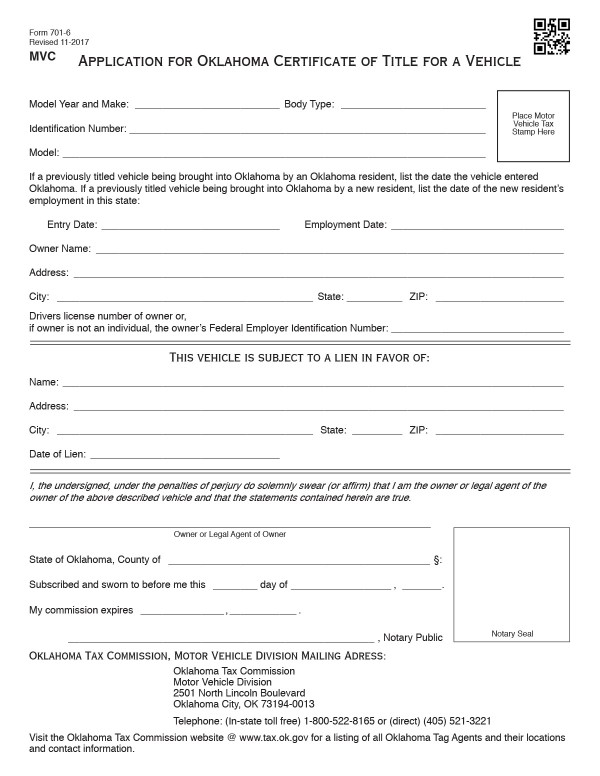

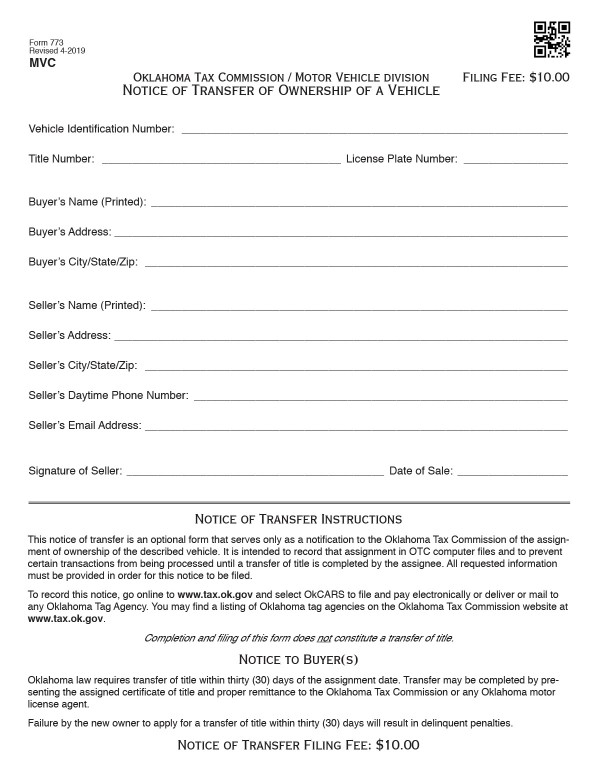

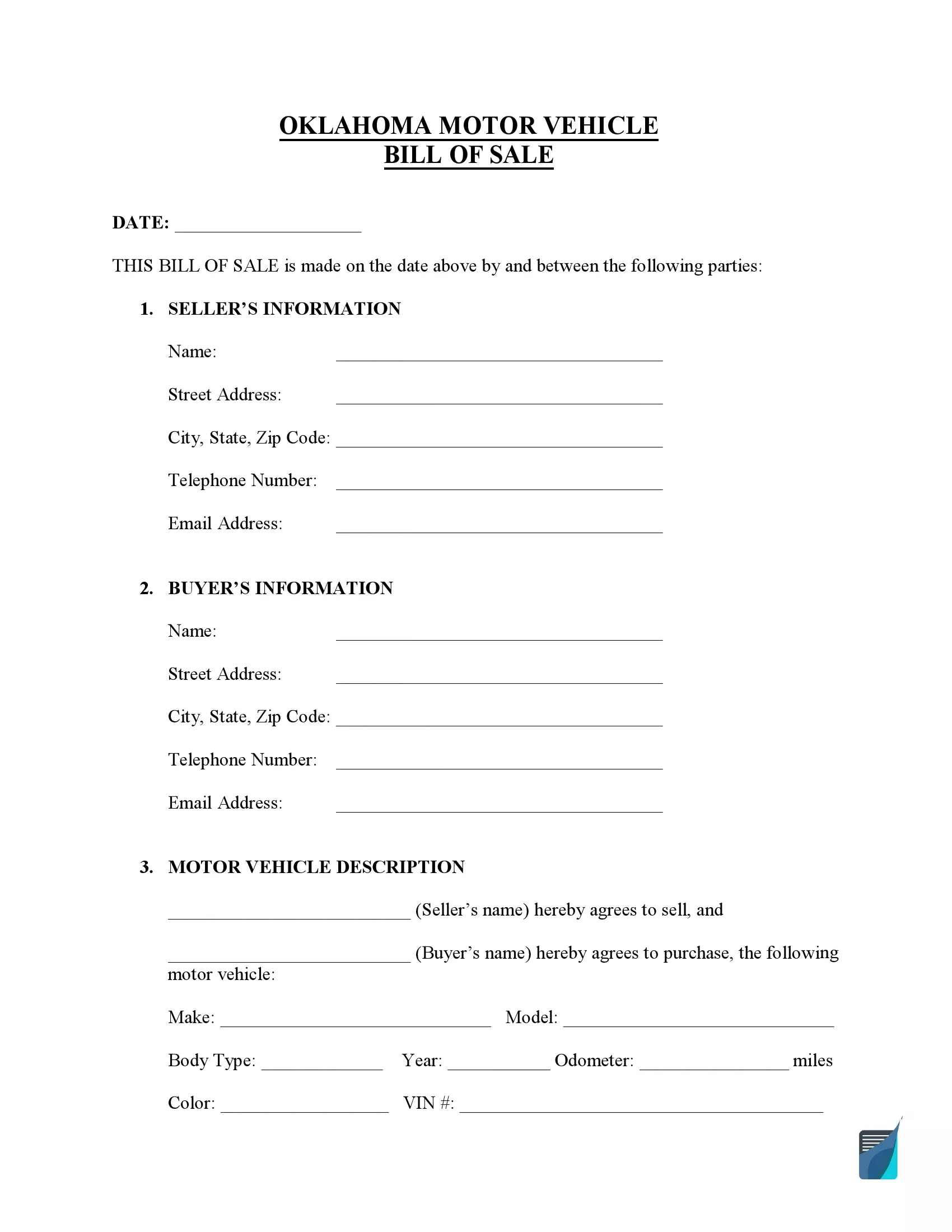

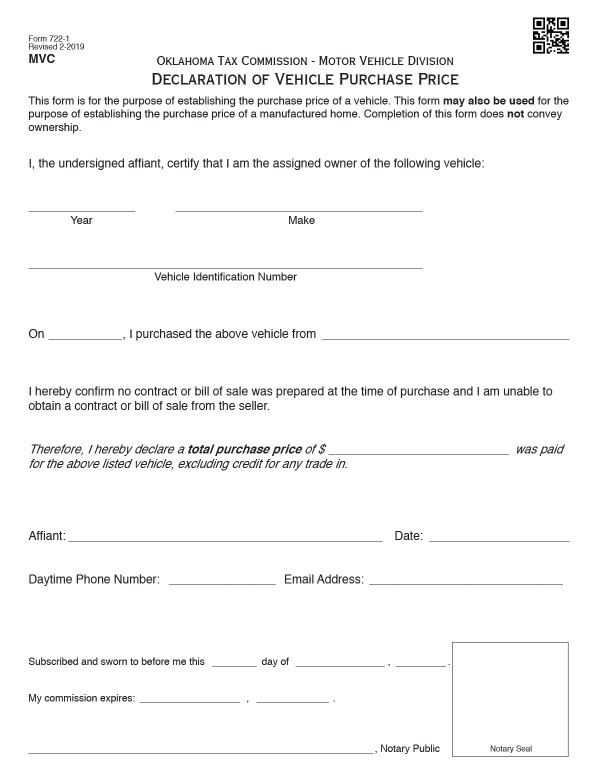

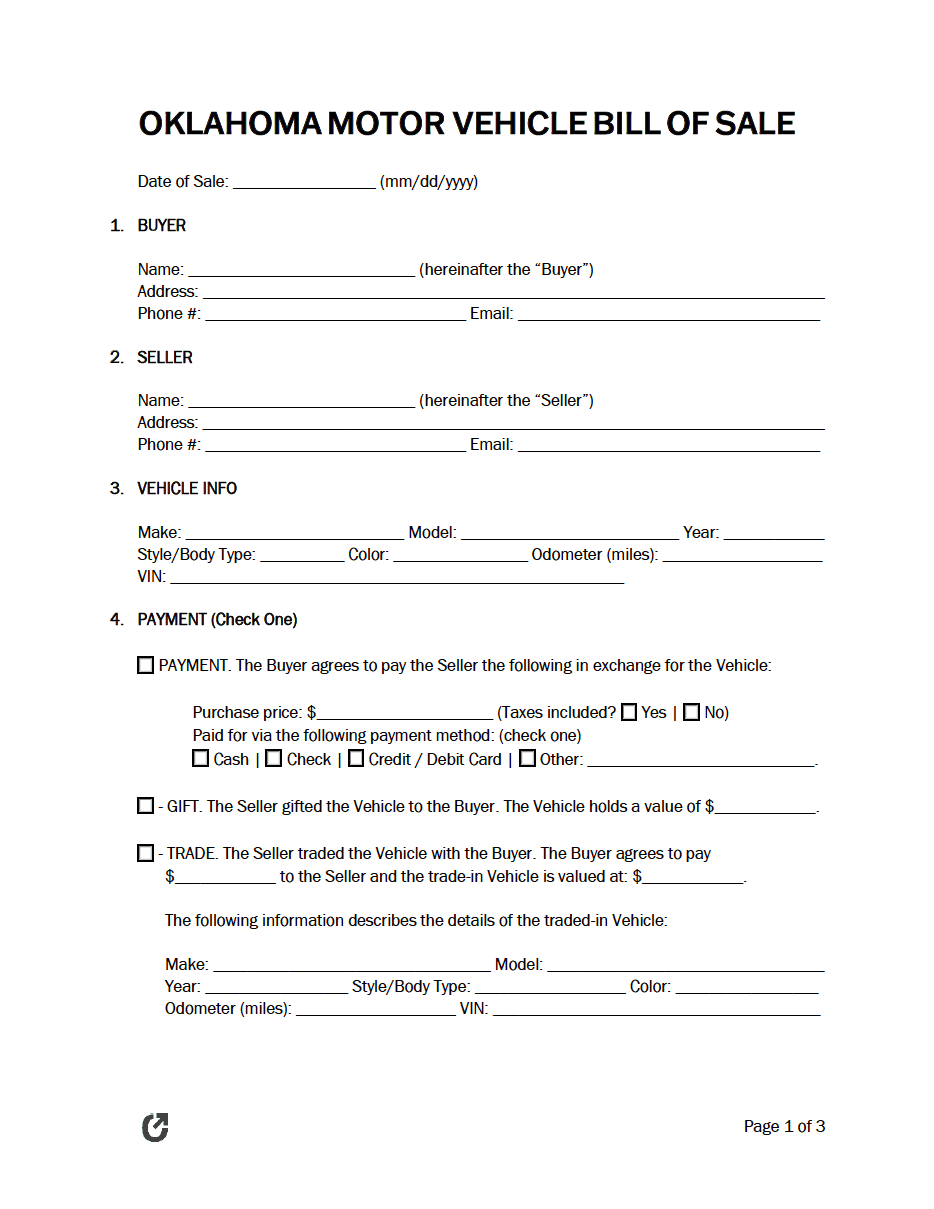

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

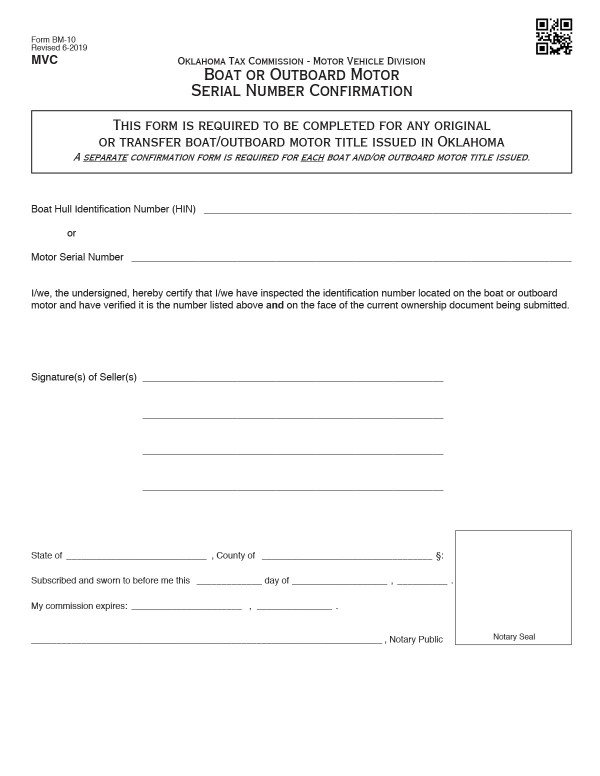

Bills Of Sale In Oklahoma The Templates Facts You Need

What S The Car Sales Tax In Each State Find The Best Car Price

How Oklahoma Taxes Compare Oklahoma Policy Institute

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

A Complete Guide On Car Sales Tax By State Shift

Bills Of Sale In Oklahoma The Templates Facts You Need

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

Car Tax By State Usa Manual Car Sales Tax Calculator

Bills Of Sale In Oklahoma The Templates Facts You Need

Bills Of Sale In Oklahoma The Templates Facts You Need

Free Oklahoma Bill Of Sale Forms 5 Pdf Word Rtf

What S The Car Sales Tax In Each State Find The Best Car Price

Oklahoma Sales Tax Small Business Guide Truic

Tesla Asks Fans In Oklahoma And Mississippi To Fight New Bills To Ban Direct Sales Of Electric Cars Electrek

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation