retroactive capital gains tax meaning

Issue Date December 1988. Bidens capital-gains tax plan may be retroactive worrying top bank CEOs.

Managing Tax Rate Uncertainty Russell Investments

That is not quite right - if no tax or penalty then why would anyone ever file a 709 form if they have nowhere near 11 million assets.

. And at the time of death the asset is stepped up to the fair-market value for heirs meaning. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. President Bidens 6 trillion spending plan reportedly assumes that his proposed capital gains tax hike begins in April meaning it would likely be too late for wealthy Americans to dodge the new levy.

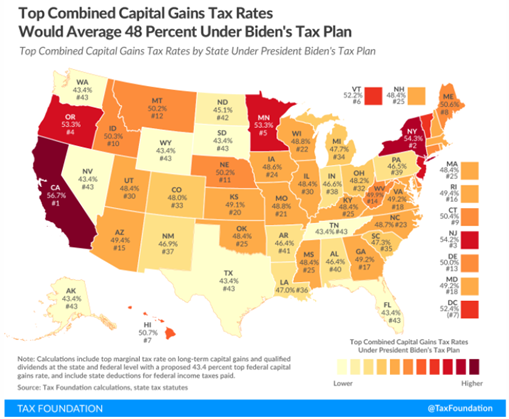

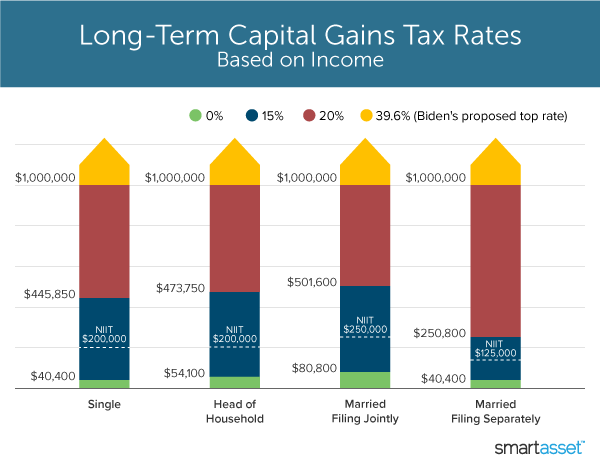

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax. Biden plans to increase this to 434 percent for households earning more than 1 million. The top rate for 2021 is 37 plus.

Clarify income tax exemptions for IMF and WBG short-term missions. JobMaker Plan - bringing forward the Personal Income Tax Plan. Encouraging Managed Investment Trusts MITs to invest in affordable housing.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. Capital Gainsinvesting rich wealthy FULL V. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when planning for the upcoming tax season. The new approach also taxes capital gains only upon. Retroactive capital gains tax reddit.

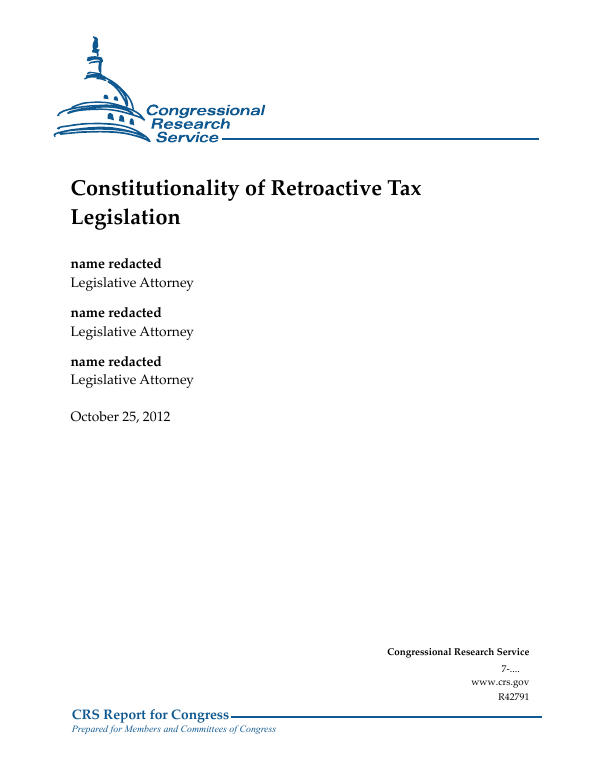

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year.

Additional ripples were felt last week when the Treasury Department announced that they intend to implement the tax hike retroactively from April 28 the date it. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along with the lock-in effect and tax arbitrage possibilities associated with this deferral advantage. President Joe Bidens proposed budget assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for high-income investors to realize gains at lower tax rates according to a Wall Street Journal report on Thursday citing people familiar with.

President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396. Capital gains are taxed favorably when compared to wage and salary income.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Income tax for individuals. Income tax on capital gains.

A Retroactive Capital Gains Tax Increase. Ordinary capital gains proceeds from sales of holdings less than a year are still taxed at ordinary rates meaning 37 for those mfj making more than 628301. Capital gains tax changes for foreign investors.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Failing to file the 709 makes the gift taxable. But retroactive capital gains taxes.

Capital Gains Tax. But many were taken off guard by the. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396.

Retroactive Gift Tax Filing to Decrease Capital Gains. The Presidential Administration made a huge splash earlier this year when announcing that the American Families Plan would be funded in part by the largest-ever increase on the capital gains tax. In this video I explain one of the top key financial terms that all successful investors know and understand.

Deductibility of COVID-19 tests. President Joe Bidens proposed budget assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for high-income investors to realize. The Wall Street Journal reported this week the effective date for.

The purpose of the 709 is to apply the gift to your lifetime exemption. Under existing law the richest Americans pay a top tax rate of 37 on ordinary income while the top tax rate on capital. The proposed capital gains increase will only be for 1mm in cap gains each year.

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

![]()

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Taxes Archives Cd Wealth Management

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

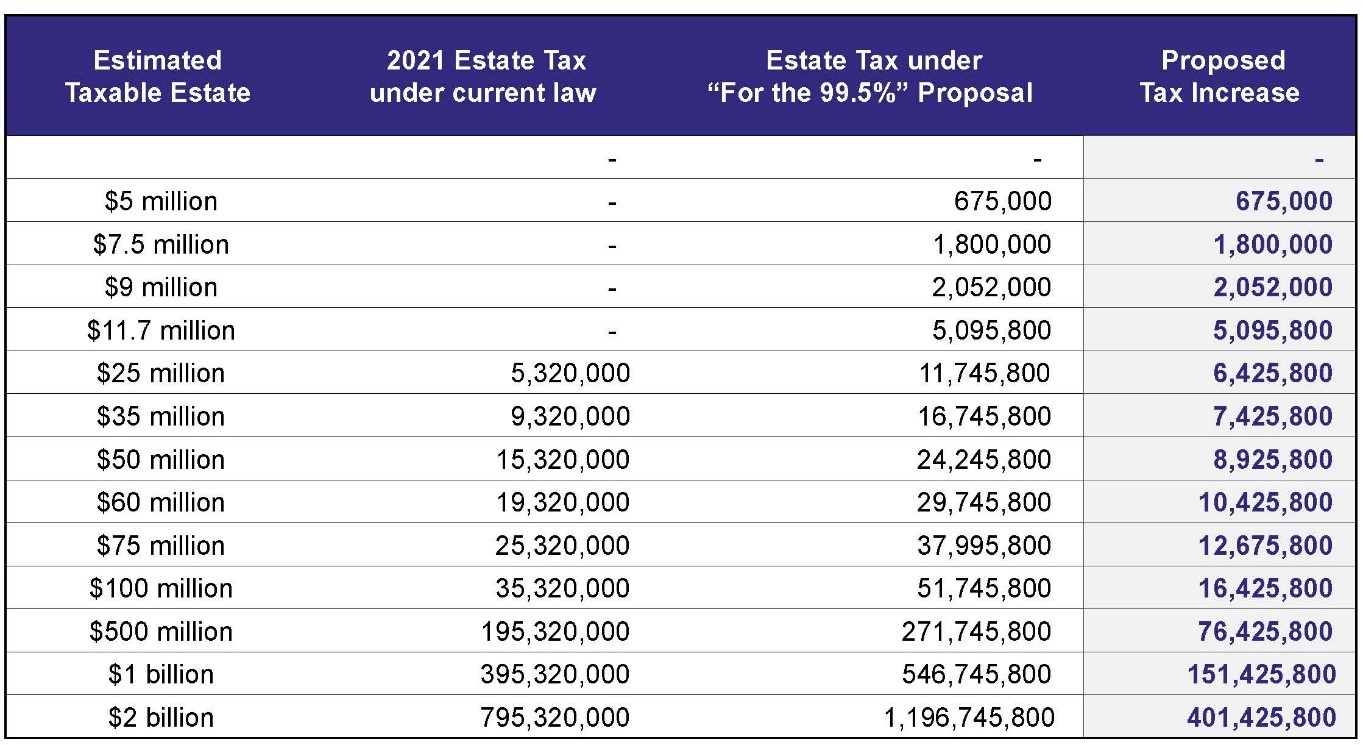

Estate Taxes Under Biden Administration May See Changes

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc